| New Tax Numbers Rebut Obama’s Class Warfare Pivot |

|

|

By Timothy H. Lee

Thursday, December 05 2013 |

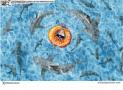

With his namesake ObamaCare in catastrophic slow-motion disintegration and his public approval numbers plummeting below his supposedly incompetent predecessor, Barack Obama is increasingly desperate to change the subject. Cue his reliable class warfare cowbell. This week, Obama preposterously labeled income redistribution “the defining challenge of our time” in a transparent effort to rally his suddenly demoralized base. Meanwhile, a new Gallup poll directly refutes Obama’s assertion, with only 1% – an ironic number – listing income inequality as “the most important problem facing this country today.” Obama’s new strategy doesn’t just contravene overwhelming public sentiment, however. It is also at odds with the facts. This week, the Tax Foundation released its second “Putting a Face on America’s Tax Returns: A Chart Book” based upon Internal Revenue Service (IRS) numbers, and it pours ice-cold water on the income inequality obsessives. For example, America’s tax burden is not only steeply progressive, it has actually grown more progressive in recent decades, not less so. Americans earning over $1 million annually accounted for just 11% of the nation’s income in 2011, but paid more than twice that portion – 23% – of the nation’s income taxes. The top 1% of taxpayers pay 37.4% of total income taxes, which is more than the combined share of the bottom 90% of taxpayers, who pay just 29.4%. Moreover, that 37.4% paid by the top 1% is up from 25.8% in the 1980s, when liberals claim that Ronald Reagan’s war on the poor began. In contrast, the bottom 90%’s 29.4% portion is down from 45.3% in the 1980s. Similarly, the top 10% of taxpayers account for an astounding 70.6% of income taxes paid, which is up from 54.7% in the 1980s. And for all of the Warren Buffett-style claims that wealthy Americans manage to pay a lower effective tax rate than middle- and lower-income Americans, the truth is that they pay more than twice as much. Today, the top 1% pays an average effective tax rate of 23%, compared to a rate of 9% for the entire bottom 99% of taxpayers. As for lower-income Americans, the bottom 20% of income earners receive $8 in federal spending for every $1 they pay in federal taxes, and the second-lowest 20% receive $3 for every $1 in taxes paid. Further, the percentage of Americans who pay no income taxes after taking credits and deductions has skyrocketed to nearly 40% today, up from less than 20% in 1980. That number particularly spiked following the Tax Reform Act of 1986, once again demolishing the myth of Ronald Regan as some sort of reverse Robin Hood. In fact, the bottom two income quintiles – covering $0 to $32,000 and $32,000 upward, respectively – not only face no income tax liability, they receive a subsidy check from the IRS. As a result, notes the Tax Foundation, “The net effect of these trends is that virtually the entire income tax burden is now being borne by the two highest groups of taxpayers.” More broadly, the Tax Foundation refutes the common claim of income bracket stagnation in America: “While America certainly has its share of people in chronic poverty, and those with vast wealth, we are an economically mobile society. IRS data tracking the same group of taxpayers between 1999 and 2007 showed that Americans can move from one economic group to another fairly quickly. For example, nearly 60 percent of taxpayers who began in the lowest income group in 1999 moved to a higher income group by 2007. Conversely, roughly 40 percent of taxpayers who started out in the highest income group moved to lower income groups within eight years.” Importantly, their analysis also refutes any claim that gains among upper-income Americans somehow come at the expense of lower-income Americans. Adjusted for inflation, since 1987 the middle 50% to 75% quartile saw its real income grow 46%, and the bottom 50% experienced a 25% increase. The top 1% was in between the two groups, at approximately 35% growth. And here’s the kicker: Income inequality has actually increased during Obama’s presidency, not decreased. The class warfare game is dangerous in and of itself, as it rests upon nothing more than envy and resentment. After all, unless one person’s income increase occurs illegally or at the expense of someone else, then it’s nobody else’s concern. Nevertheless, if Obama and others insist on playing that game, Americans should arm themselves with the facts. |

Related Articles : |