| America's Fiscal Ethos: From Alexander Hamilton's Day to Our Own |

|

|

By Veronique de Rugy

Thursday, April 11 2024 |

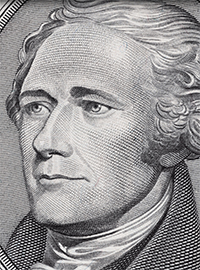

Washington Post columnist Megan McArdle recently wrote that the best argument made in favor of limiting the size of the stimulus during the Great Recession – part of a larger conversation about austerity – was one of ethos. "We weren't spending the money in theory," she wrote, "or in 1945, when an ethos of fiscal responsibility prevailed. We were spending it in the 21st century, when that ethos had collapsed, so there was a considerable chance that when the good times finally rolled around, no politician would willingly undertake the sacrifices necessary to get the budget back in shape." She got me thinking about America's fiscal norms. It's fair to say that the ethos of sound fiscal and monetary policy started with none other than Alexander Hamilton. In his January 1790 Report on Public Credit, Hamilton advocated for fully funded permanent public debt. This report laid the groundwork for a financial system supported by securely backed debt together with commodity money. Later that year, Hamilton proposed the establishment of the Bank of the United States. Though not a central bank by today's standards, he thought it crucial for securing federal credit and a stable currency. Hamilton recognized the interconnectedness of fiscal and monetary policies. Since then, the United States and most stable countries have developed norms guiding different kinds of policy behavior. U.S. monetary policy norms have largely evolved through legislative actions, shaping the roles and responsibilities of our central bank – the Federal Reserve – in managing the currency and responding to economic shifts. By contrast, according to University of Virginia economist Eric Leeper, America's fiscal policy norms have emerged more informally. These have been shaped by historical practices and significantly influenced by Hamilton's understanding of dynamic economic behavior. Contrary to monetary policy, which has fairly stable and clear policy objectives (a stable price level and full employment), fiscal-policy objectives are unclear and always changing. This makes the norms that guide policymakers more important. Leeper highlights three fiscal norms. One, established in one of Hamilton's 1790 reports, is that budget deficits should be followed by budget surpluses (i.e., the government pays off its debts). The second is that ordinary spending should be paid for with taxes while emergency spending can be paid with borrowed funds to be repaid later. The third is that austerity becomes necessary when interest payments on outstanding debt become a sufficiently large fraction of federal expenditures. Despite their informal nature, these fiscal norms have historically constrained U.S. fiscal policy in a meaningful way, even without a gold standard or other formal devices often found in history. They're also important because they determine long-term expectations for fiscal policy. These expectations, in turn, influence bond prices, inflation and the real economy, keeping things relatively stable. So far, adherence to these informal fiscal norms has paid off. U.S. Treasuries are a cornerstone of the global financial system, serving functions akin to money worldwide. However, the norms are weakening. While legislators have not abandoned the idea of repaying all the debt, they are making decisions that will eventually make it much more difficult. Further, since the Great Recession, emergency spending financed with debt hasn't spurred the creation of fiscal surplus to repay it. A look at the debt-to-GDP ratio since 2008 shows an upward trajectory with no plans to return to pre-2008 levels. In addition, after the roughly $6 trillion in COVID emergency spending – and unlike the Obama administration post-Great Recession – the Biden administration has not acknowledged the need for austerity. Debt-service costs are going through the roof, with interest payments growing to $1 trillion a year and eclipsing defense and Medicare spending, yet the administration shows no notable willingness to course correct. In fact, as McArdle notes, "President Biden isn't talking about fiscal sanity; he's talking about massive child-care subsidies" and about more student debt forgiveness. The fear is that eroding fiscal norms will change investors' expectations about being repaid for government debt, something that comes with just about every bad economic consequence one can imagine. The breakdown can also affect monetary policy. With federal debt equaling 100% of GDP, most of it financed through short-term bonds, any interest rate hikes dramatically increase the budget deficit. This could affect the Fed's ability and willingness to fight inflation with more rate hikes and further debt increases. An ethos of fiscal responsibility and healthy fiscal norms are a big deal. We should lament their erosion. Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. COPYRIGHT 2024 CREATORS.COM |

Related Articles : |