| Crony Capitalists Propose a Carbon Tax to … Reduce Energy Costs? |

|

|

By Timothy H. Lee

Thursday, April 28 2022 |

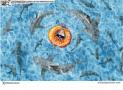

Remember when Joe Biden pitched his "Build Back Better" boondoggle? He insisted with a straight face that pouring trillions of additional government dollars into an inflationary economy would somehow reduce inflation. In support of that facially preposterous assertion, the Biden Administration tweeted, “17 Nobel Prize winning economists have said the plan will ease inflationary pressures and help more Americans participate in the economy.” Of course, that was back when Biden and the same economists also assured us that rising inflation was merely “transitory.” A year later, we’re experiencing record inflation even without those additional trillions of dollars saturating the economy. Imagine how much worse off we’d be if "Build Back Better" had actually passed. In any event, recent days have witnessed a proposal that may equal or even exceed Biden’s sales pitch in its sheer outlandishness. Namely, a coalition of entrenched business interests advocate a new carbon tax to – get this – reduce rising energy costs. You read that right. Groups like the Business Roundtable advocate increasing energy production costs in order to somehow reduce energy costs: Business Roundtable urges policymakers on both sides of the aisle to depoliticize energy policy and work with the business community to take swift action on the following suite of policies… (6) Establish a price on carbon* that provides a clear long-term signal and incentivizes development and deployment of technologies to lower emissions, and lead on intentional efforts to align potential cross-border carbon measures… *Business Roundtable supports a market-based emissions reduction strategy that includes a price on carbon where it is environmentally and economically effective and administratively feasible, but it does not endorse any specific market-based mechanism. Former Republican Lieutenant Governor of Maryland Michael Steele, who rebranded by endorsing Joe Biden and chasing leftist approval in guest appearances on MSNBC, offered his best Biden impression by asserting that, “Business Roundtable’s proposal would lower energy prices for Americans, strengthen our economy, and allow the U.S. to better compete around the world, including with China.” In fact, the Congressional Research Service estimates that a carbon tax of this sort would increase gas prices by 46 cents per gallon. Sacrificing intellectual integrity to keep your name in headlines isn’t a good look on you, Michael. So why would big business masochistically advocate new carbon taxes? It’s a classic case of regulatory capture and crony capitalism. Specifically, big businesses can more easily navigate new regulatory thickets that they helped create, pivot business models to accommodate costly government-favored green energy technologies and curry favor with political leaders and administrative state officials. Greg Ip of The Wall Street Journal captured the unspoken motive behind this unseemly maneuver: The surge in global energy prices triggered by Russia’s invasion of Ukraine sure doesn’t seem like any sort of blessing… And yet for Mr. Biden, there may be a silver lining. Higher prices, if sustained, could reduce global fossil-fuel consumption and encourage the shift to zero-emission energy… Like other world leaders, Mr. Biden has committed to slash emissions of carbon dioxide and other planet-warming greenhouse gases by 2050. To achieve this Mr. Biden has relied on regulatory and executive actions, such as cracking down on methane leaks from wells and pipelines and restricting leasing and drilling on federal land. Climate activists, meanwhile, have sought to pressure investors, banks and major oil companies to divest from fossil fuels. The problem with such efforts is that they do little to alter global demand for fossil fuels, the ultimate driver of climate warming, but will reduce how much of that demand is met by U.S. suppliers, as opposed to Russia and OPEC… A more efficient way to combat climae change would be a price on carbon, such as a tax… So there you have it. Biden and the political left seek to eliminate cheaper and more efficient energy sources like oil and natural gas in favor of costly “green” energy boondoggles, while climate activists relentlessly pressure politicians and businesses to act accordingly. So how to accelerate that agenda when Biden’s regulatory war on energy isn’t working as well as desired? Introduce a new “price on carbon” to drive up costs for consumers even higher. And as a sales pitch, assure consumers that all of this is part of a grand plan to actually reduce their energy costs. Fortunately, some elected leaders are still on the beat. House Minority Whip Steve Scalise (R – Louisiana) and Representatives Markwayne Mullin (R – Oklahoma) and Jeff Duncan (R – South Carolina), called out the carbon tax proposal for what it is: At a time when skyrocketing inflation is hammering American families, it is shocking and tone-deaf that the Business Roundtable’s latest energy policy proposal calls for a new energy tax that would increase energy costs even higher while also pushing for crony tax credits that will only benefit special interests and Washington insiders… Advocating for an energy tax while soliciting massive government handouts for special interests is destructive, ineffective, and unaffordable. If the Business Roundtable really wanted to promote a forward-thinking energy strategy for America, they would stand up for their members and American workers by advocating for more American energy production to lower costs and carbon emissions, and they would abandon the idea of adding crushing new energy taxes that will hit hard-working families who are already struggling under the weight of President Biden’s runaway inflation and Washington spending. They’re right. America was energy independent when Joe Biden took office. His policies, driven by the extreme political left, have only driven up prices, reduced our energy independence, undermined global stability. To correct this worsening state of affairs, we must pursue pro-energy and free-market policies, not further abandon them. |

Related Articles : |