| Targeting Short-Selling Is Short-Sighted |

|

|

By Timothy H. Lee

Thursday, March 25 2021 |

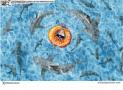

As we pass the otherwise grim one-year coronavirus pandemic milestone, perhaps the most remarkable bright spot for which we can remain grateful is the astonishing resilience of the American economy and stock markets. With the Dow Jones Industrial Average surpassing the 33,000 barrier this month, we’re now within eyesight of the once-ridiculed title of the 1999 James Glassman book “Dow 36,000.” That doesn’t just inure to the benefit of Wall Street. As we’ve highlighted, 53% of American households currently own stocks, and between 80 million and 100 million Americans maintain 401(k) accounts that depend heavily upon stocks. Additionally, retirees and those with pension plans – including police, firefighters, teachers and other public servants – also benefit enormously from rising stock markets. Despite that, some seek to introduce a destructive “financial transaction tax” that would broadly hit every variety of financial exchanges, including stocks, bonds, derivatives and other means of wealth accumulation. It’s as if they meticulously seek any sector of the American economy that continues to prosper in order to deliberately tax it into malaise. In other positive news, however, strong majorities of Americans oppose financial transaction tax proposals. According to a new U.S. Chamber of Commerce Center for Capital Markets Competitiveness survey, fully 63% of respondents oppose that type of tax, including 51% of Democrats, 69% of Independents and 80% of Republicans. Additionally, a 51% majority reports that they would be less likely to invest if a financial transaction tax passed, including 34% who say they would be much less likely. That degree of bipartisanship sends an unequivocal signal to Congress and the Biden Administration that financial transaction tax proposals should be stopped in their tracks. In another related effort every bit as dangerous to American markets, some political leaders now target what’s known as “short-selling” for restriction or outright prohibition. On the heels of the phony "crisis" surrounding GameStop trading episode, some activists and politicians predictably seek to exploit the matter to impose their higher-tax and suffocating pro-regulation wish list. For those unfamiliar, a “short sale” simply refers to a series of transactions undertaken when a trader considers a stock overvalued. Specifically, the trader borrows a stock at its current market value and in turn sells it to another purchaser at that price. Then, the traders wait for the stock’s value to decline as anticipated, at which point they buy that same stock at a lower price than the price at which they sold the borrowed stock. They then return the stock to the original lender from whom they borrowed the stock, profiting on the difference. To illustrate, imagine an investor who believes that hypothetical Acme Inc.’s stock price is overvalued at $100 per share. Accordingly, that investor borrows Acme stock at $100 per share, and sells it to another buyer at that same price. Some time later, imagine that Acme stock falls to $50 per share, at which point the investor snatches up shares at that price to return to the original lender. Since the stock being returned to the original lender was bought for $50, the investor pockets a $50 per share profit, which was the difference between the $100 per share sale of the borrowed stock and the $50 purchase of the replacement shares. Keep in mind that there’s no guarantee that the expectation will prove correct. If the hypothetical Acme Inc.’s stock increases in market value after the initial borrow and sale, the investor loses money by having to purchase shares at a higher price to return to the original share lender, thus paying the price for an incorrect expectation of share decline. That’s how markets work. In other words, short-selling is a perfectly reasonable transaction for someone who believes that a company’s stock is overvalued. That explains why the Securities and Exchange Commission (SEC) determined that short sales account for fully 49% of all listed equity share volume, and why The Wall Street Journal’s Holman Jenkins noted that there’s nothing particularly salacious about them: This is a failure of understanding of the sort that social media is good at promoting and giving force in our world. Short sellers don’t prevail by manipulating prices but only if other investors decide a security is overvalued (see Tesla). Short sales, in fact, are indistinguishable from the zillions of trades that cross the tape and are gone in a nanosecond in a market where a company’s entire outstanding shares can change hands in an afternoon. A short is different from other trades in only one respect: Ironically, it creates a legal obligation to buy the shares in the future regardless of price. Short-selling serves an important function in markets, which is why any effort to restrict or even prohibit it presents such danger. Namely, short sale investors help to challenge inaccurate conventional market wisdom, and to identify bubbles, overpriced stocks and wise investment opportunities. Those stocks might be overpriced due to underlying improper internal business practices, as was the case with Enron, Tyco and Worldcom. In other instances, the subject stocks might be overpriced due to looming technological innovations or market changes, and short-selling signals approaching downturns like the 2008 housing market collapse to the rest of the world. Accordingly, short sales provide an invaluable market service by sending important signals to investors and consumers, thereby protecting investments and people’s savings. Along with new proposals to tax financial transactions, efforts to restrict or eliminate short sales must therefore be recognized as the threats that they are, and rejected accordingly. |

Related Articles : |