| The Supposed “Obama Recovery” May Prove a Sugar High |

|

|

By Timothy H. Lee

Thursday, August 06 2009 |

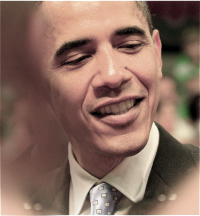

As Milton Friedman famously observed, “there’s no such thing as a free lunch.” Friedman’s adage may prove particularly poignant in upcoming months, as America witnesses the broader effects of what may be a “sugar high” recovery. Namely, our short-term stimulus may come at the expense of longer-term pain. The positive news, of course, is that the current economic downturn appears to be nearing its natural conclusion, just as all recessions eventually reach their end. This month, the United States Department of Commerce reported that America’s gross domestic product (GDP) contracted at a 1% rate during the second quarter, the slowest level of contraction in one year, following a 6.4% contraction in the first quarter and a 5.4% contraction in the fourth quarter of 2008. It’s still an economic decline, but a more moderate decline. Other economic measures have also stabilized, including housing prices, manufacturing data, stock indexes and corporate profits. Further, economists generally expect that the third and fourth quarters of 2009 will witness GDP growth, marking the first positive numbers since the first quarter of 2008. Naturally, Barack Obama and his loyal chorus have been quick to claim credit for bringing America “back from the brink of disaster” and setting us on a path of sustainable growth. But is that really the case? Or is this a temporary uptick with troubling prospects for longer-term prosperity? As many economists have begun to note, the pending GDP upturn may not really constitute a healthy economic recovery so much as a statistical necessity, in the same way that even a dead cat bounces off the hard pavement. To illustrate, one must remember that negative economic numbers cannot keep declining forever. Rather, they can only plummet so far, and must eventually bottom out toward zero. Inventory stocks, for example, can show negative rates as liquidation occurs, but they obviously cannot decline below zero. At a certain point, businesses and consumers cannot pare any more, and must replenish the goods on which they depend. When that occurs, the mathematical result is that GDP numbers moderate, and eventually rise in comparison to the quarters during which drastic inventory clearing occurred. In addition to this statistical phenomenon, governmental “stimulus” spending and near-zero Federal Reserve rates have flooded the market with dollars. As a consequence, economic activity has received a temporary jolt, and the prospect of more federal dollars along with Ben Bernanke’s promises of continued easy money provide sugar calories to the system. But what about the implications for broader American prosperity? After all, excessive monetary easing by Bernanke and the Federal Reserve can create the type of asset bubbles and inflationary pressures that helped cause the current recession. And all of those federal dollars being spent through the “stimulus” bill? They must eventually be paid through higher taxes, new borrowing or by printing dollars out of thin air. Higher taxes will stifle growth and shift dollars from productive uses in the private sector toward inefficient bureaucracies. New borrowing will only compound budget deficits and national debt, which is already scheduled to triple over the next ten years. And printing dollars out of thin air will merely fuel inflation and the type of commodity price increases that we witnessed last summer when oil rose to over $140 per barrel. As if these threats weren’t enough, Obama and the Pelosi/Reid Congress are now asking Americans to shoulder healthcare legislation that would quickly add $1 trillion more to our existing burdens, and suddenly tax employers and citizens who didn’t possess insurance plans. They’re also pushing unworkable carbon cap-and-tax proposals that would cost consumers and businesses, higher income tax rates, higher capital gains tax rates, taxes on consumer products such as cigarettes and soft drinks, new regulatory powers for agencies that failed to prevent the housing and asset bubbles in the first place, counterproductive trade protectionism and job-killing labor legislation demanded by Big Labor special interests. Add it all up, and America’s long-term growth forecast becomes much cloudier. We have learned time and again that long-term growth and prosperity do not arise from temporary infusions of federal dollars that must eventually come from higher taxes, borrowing or inflationary money-printing. Rather, sustainable economic success springs from lower taxes, freer markets and less bureaucratic strangulation. Something to consider before we pop the celebratory champagne corks or place any merit in Barack Obama’s new round of self-congratulation. |

Related Articles : |