| Dems' Tax Demagoguery |

|

|

By Betsy McCaughey

Wednesday, November 08 2017 |

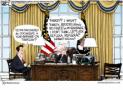

Senate Minority Leader Chuck Schumer and the Democratic Party are trying to torpedo the biggest tax cut since 1986. Schumer accuses GOP tax cutters of "messing up the good economy the president inherited from President Obama and hurting the middle class." The senator must think we're stupid. The Obama economy wasn't "good." It was lousy, sputtering along at a pathetic 2.1 percent, far below the 3.8 percent norm for this nation. Who got clobbered? The middle class, who had to settle for almost no increase in wages and disappointing job prospects. The Tax Cut and Jobs Act, unveiled by House Republicans on Thursday, is designed to ignite the nation's economy, producing higher wages and more job opportunities for workers. America taxes corporations at the highest rate of any industrialized country. That drives companies overseas, sabotaging our workforce. The GOP tax cut lowers the corporate from 35 to 20 percent, to make the U.S. competitive again. As for the middle class, they'll benefit in two ways—from a faster growing economy and from tax breaks for individual filers. The GOP plan nearly doubles the standard deduction to $12,200 for single filers and $24,400 for married couples, and lowers most rates. It pays for those changes by eliminating certain deductions. The impact on your wallet will depend on the deductions you're used to taking. But a typical family earning $73,000 a year would save about $1,600 the first year. The House and Senate aim to pass bills before Thanksgiving, and then smooth out their differences and enact a final law by Christmas. Changes would be effective Jan. 1—if reform passes. What are the prospects? Certainly better than the GOP's thwarted Obamacare repeal. Despite hard-nosed efforts by Schumer and House Minority Leader Nancy Pelosi to keep Democrats lined up against tax reform, a handful might vote "yes." It's harder to vilify tax cutters than to scaremonger over losing health insurance. Most people like keeping more of what they earn. Schumer, undaunted by facts, proclaims that "tax cuts like these benefit the wealthy and the powerful to the exclusion of the middle class." Sorry, Senator. That's untrue. Start with the corporate tax cuts, which are the lion's share—about 80 percent—of the cuts. The president's Council of Economic Advisors shows that in numerous countries, lowering corporate tax rates boosted wages. It will work here too, argue economists Gregory Mankiw of Harvard and Casey Mulligan of the University of Chicago. Schumer trivializes their evidence as "fake math." The GOP tax plan also allows businesses to write off the full cost of equipment when purchased, encouraging businesses to invest in productivity-enhancing tools. Workers who produce more get paid more. These reforms promise to liberate workers from wage stagnation. Among individual taxpayers, there'll be more winners than losers. But you'll no longer be able to deduct state income and sales tax—bad news if you live in tax hell, meaning New York, New Jersey and California. Let it be an incentive to retire the taxaholics and profligate spenders controlling politics in these states. If you're planning on buying a home, you'll be able to deduct interest only on the first $500,000 borrowed for a primary residence, and nothing for vacation homes. But stay tuned—this provision may change. Huge medical expenses will no longer be deductible. Nor will interest on student loans or alimony. Most taxpayers won't feel the pain because of the bigger standard deduction. But lobbyists are in a frenzy. Every current deduction has defenders, including homebuilders, mortgage lenders and politicians from high-tax states gorging at the public trough. They'll likely win some concessions in the coming days. The surest losers are tax accountants and lawyers. Simplifying the tax code enables people to file on their own. In the end, it's a battle between the overtaxed public and insiders who make their living off our tax payments. Betsy McCaughey is a senior fellow at the London Center for Policy Research and a former lieutenant governor of New York State. |

Related Articles : |