| Corporate Mergers Are Under Attack, But Not on Your Behalf |

|

|

By Veronique de Rugy

Friday, August 18 2023 |

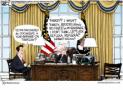

Last month, the Department of Justice (DOJ) and Federal Trade Commission (FTC) published a draft of proposed new guidelines for mergers and acquisitions. Sounds like a problem reserved for people who sit in board rooms, right? Not exactly. Such rules will affect all of us. If implemented, the proposal will preemptively block private-sector corporate transactions with little regard for the actual impact on consumers. This power grab by progressives in the Biden administration would shift antitrust law from standards that corporations and courts can understand to a series of vague and ambiguous "guidelines" that only give bureaucrats greater power over corporate America. Despite the common handwringing over corporate mergers and acquisitions, they should be subject to free market forces. And if there is a role for the government to superintend mergers, the guiding standard should be consumer welfare – the prices we all pay, as well as the quality and quantity of the products being made available to us – rather than politicians' belief that bigger equals bad or the perception of unelected officials that all mergers are problematic. Yet as explained by my colleague Alden Abbott, a former Federal Trade Commission general counsel, the proposal reads as "an anti-merger manifesto." The project is driven by controversial FTC Chair Lina Khan and designed to greatly enlarge government-erected barriers to mergers and acquisitions. In doing so, the guidelines would ignore decades of counterintuitive academic findings about how firm concentration can have a positive impact on consumers' welfare. It ignores the well-established economic benefits of vertical and horizontal integrations. Vertical integration – when a company merges with one of its suppliers – often leads to more innovation. Take when Apple acquired FingerWorks for its touchscreen technology that then paved the way for the iPhone. Meanwhile, as prior officials at the FTC and DOJ explained back in 2006, horizontal mergers – when a firm merges with a competitor – often help companies better compete to please customers domestically and overseas. For those still concerned about corporate behemoths, the Cato Institute's Scott Lincicome reminds us that "mergers – even really big ones – don't ensure that a firm will suddenly become an unstoppable, anti-competitive force in a market and sometimes, in fact, can spark a once-thriving company's downfall." Think of Yellow Trucking and Roadway, AOL and Warner, or DaimlerChrysler's post-merger disasters. "Who cares?" seems to be Khan's attitude toward these data-rich findings. Specifically, her draft lowers the merger-concentration threshold – that which requires notifying the FTC and Justice Department of a deal – to $144 million (not exactly what establishing a monopoly costs these days). The number of corporate mergers under serious government and political examination would skyrocket as a result. That, at the very least, would add several months of delays, thus disincentivizing some healthy mergers and acquisitions. Khan and her lieutenants simply, but mistakenly, assume that there's little-to-no cost to such delays. The second, and more dangerous, change is the DOJ and FTC's proposal to implement 13 vague new guidelines. As Abbott argues, the federal government is setting up a "pick and choose" laundry list of potential pitfalls ascribed to mergers. The government would intervene on hypothetical grounds that are written in subjective language that completely ignores consumer welfare. It does so without ever bothering to demonstrate "any sensitivity to the potential procompetitive" benefits of the merger or acquisition in question. The lack of required evidence to trigger enforcement is best characterized as "I know it when I see it." Consumer welfare should be the sole standard for antitrust law. Economist Brian Albrecht wrote in National Review last December about the shift from the "Government always wins" antitrust standard that was successfully pushed by progressives until abandoned in the late 1970s. An emphasis on tangible economic reasoning allowed a consistent framework to take shape, including "the elevation of consumer welfare as antitrust regulation's fundamental concern." Chair Khan is trying to turn back the clock to a standard that will again allow the FTC and DOJ to always win. Finally, big changes to law should be enacted by Congress and then signed by the president. One does not have to be a constitutional scholar to understand the value of the separation of powers and the idea that bureaucrats serving a president shouldn't have the power to make moves this consequential simply by issuing new guidelines. Yet this is what these new guidelines are doing without hearings, debate and the votes of our elected representatives. Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. COPYRIGHT 2023 CREATORS.COM |

Related Articles : |