| Amid Economic Uncertainty, Law Targeting Short Sales Would Backfire |

|

|

By Timothy H. Lee

Tuesday, July 27 2021 |

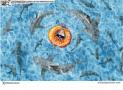

After several months of steady economic recovery, we are once again facing economic uncertainty and peril. Last month, the Federal Reserve significantly raised its projections for inflation and moved up its timeline for interest rate hikes. Against this backdrop, some lawmakers in Washington, D.C. like Congresswoman Maxine Waters (D – Calif.) are pushing new regulations on our financial system that would only compound economic challenges. Now there is harmful legislation working its way through the House Financial Services Committee that takes direct aim at short selling, an important but highly misunderstood investment tool. If this new proposal becomes law, it will come with widespread financial pain at a time the country can least afford it. Anticipating and reacting to market developments is critical in the face of rising inflation volatility, especially for institutional investors like pensions, which require reliable returns for members. But the latest proposal, the Short Sale Transparency and Market Fairness Act (H.R. 4618), would severely limit short selling for these investors and threaten the financial security of their beneficiaries – including millions of retirees. The bill is a drastic overreaction to the GameStop episode earlier this year and would cause real harm to the people it’s supposed to help. In the name of protecting the little guy, H.R. 4618 would restrict investment tools that fund pensions supporting the retirement income of teachers, firefighters, police officers, first responders, and other public employees. The unintended consequences from this bill far outweigh any perceived gains in transparency. During a time when retirement insecurity is a growing problem for millions of workers, it’s alarming that Congress would hurt the investments that make retirement more attainable. Before Congress goes further down this road, they must understand what short sales are and why they are necessary for investors as well as a healthy, functioning market. “Short sales” simply refer to financial transactions executed when traders consider certain stocks overvalued. In such cases, traders borrow the stocks in question at current market value, and then sell them to willing purchasers at that same price. The short sellers then wait for the stocks’ value to decline, at which point they buy the same stock at a lower price than the price at which they borrowed and sold the stock. Finally, they return that stock to the original lender from whom they initially borrowed, thus profiting on the difference. It’s important to remember, however, that there’s no guarantee that the short seller’s expectation of a stock’s market price decline will actually occur. If hypothetical Stock A’s market price instead increases to $150 per share when the borrowed shares must be returned, then that investor loses $50 per share from having to purchase shares at a higher price to return to the original share lender, thus paying the price for an incorrect expectation of share decline. That’s how markets work, and should work. Moreover, short sales serve a critical signaling role in markets and our economy, which is why H.R. 4618 is so dangerous. Contrarian short sellers challenge conventional market wisdom, and thereby help identify potential bubbles, overpriced stocks and wise investment opportunities. The stocks in question might be overpriced due to underlying improper internal business practices, as was the case with Enron, Tyco and Worldcom. In other instances, the subject stocks might be overpriced due to looming technological innovations or market changes, and short selling signals approaching downturns like the 2008 housing market collapse to the rest of the world. Nor is this a particularly American dynamic, as England’s Financial News recently reported: Short-selling investors, including hedge funds, helped public pension funds and European regulators by exposing the massive accounting hole at high-flying fintech company Wirecard. Nearly $2bn in cash is missing and no one knows where it is or if it ever actually existed. The firm’s former CEO has been arrested and the full extent of the cover-up is to be determined. But for the important work of short sellers, investors across Europe would have kept pouring cash into the firm. Accordingly, short sales provide an invaluable market service by sending important signals to investors and consumers, thereby protecting investments and people’s savings. The effort to restrict short sales through the Short Sale Transparency and Market Fairness Act would inhibit American markets and investments at the worst possible time, hurting Main Street Americans in the process. What the American economy needs at this moment of sudden peril is more certainty and flexibility, not less. |

Related Articles : |