| 2022 Index of Economic Freedom: Biden Drags U.S. to All-Time Low of 25th |

|

|

By Timothy H. Lee

Thursday, May 12 2022 |

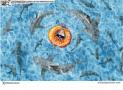

In today’s polarized culture, debate is characterized more often by normative subjectivity than empirical objectivity. Even where one side in a debate possesses an advantage of common sense and lessons learned through experience, objective resolution is often impossible and people must simply agree to disagree. It’s therefore refreshing when a matter of common debate becomes subject to quantifiable fact and demonstrable correlation. Such is the case in the ongoing debate over the merits of economic freedom versus greater government control. Each year since 1995, the Heritage Foundation’s Index of Economic Freedom measures the world’s nations on a scale of 0 to 100 in 12 categories of economic freedom, grouped into four broader general categories: (1) Rule of Law (which includes the subcategories of property rights, government integrity and judicial effectiveness), (2) Government Size (which includes government spending, tax burdens and fiscal health), (3) Regulatory Efficiency (which includes business freedom, labor freedom and monetary freedom) and (4) Open Markets (which includes trade freedom, investment freedom and financial freedom). On the basis of those scores, nations are categorized into one of five categories: (1) Free, (2) Mostly Free, (3) Moderately Free, (4) Mostly Unfree and (5) Repressed. In turn, the Index statistically correlates nations’ economic freedom with their prosperity and overall wellbeing: The benefits of economic freedom are well established, starting with higher per capita incomes. Rising economic freedom supports faster economic growth. Other benefits associated with economic freedom include better education and health outcomes and cleaner natural environments. Countries where people have greater economic freedom have less poverty, more innovation, more robust democracies, and greater social progress. As just one illustration, nations in the “Free” category claim average incomes of $73,973, while “Mostly Free” nations stand at $42,519, “Moderately Free” nations at $21,803, “Mostly Unfree” countries at just $9,917 and “Repressed” nations a paltry $7,096. The decline is steep and unambiguous. In this year’s Index, 7 nations qualify as “Free”: (1) Singapore, (2) Switzerland, (3) Ireland, (4) New Zealand, (5) Luxembourg, (6) Taiwan and (7) Estonia. Unfortunately, the news as it relates to the United States is not encouraging. When Heritage published its first Index in 1995, the United States ranked 4th. In this year’s Index, we’ve plummeted to 25th, our lowest ranking ever: The 2020 pandemic throttled relatively solid economic growth that had been stimulated by tax cuts and a lightened regulatory burden. Unfortunately, unchecked deficit spending and unprecedentedly accommodative monetary policy not only continued, but also accelerated in 2020 and 2021. Meanwhile, racial tensions and bitter political polarization aggravated by the pandemic have deepened, especially since the 2020 presidential election. Since assuming office in 2021 with narrow control of both houses of Congress, President Joseph Biden has pursued a radical left agenda aimed at fundamentally transforming both the country and the economy. Notably, when Barack Obama entered the White House in 2009, the United States ranked 6th in Heritage’s Index. But by the time he departed, we’d plummeted to 17th, and had fallen from its “Free” category to “Mostly Free.” As the 2019 Index highlighted, however, the U.S. improved significantly and rapidly under President Donald Trump: According to the Heritage Foundation’s 2019 Index of Economic Freedom, America’s economic freedom has seen a dramatic boost – from 18th place in the world to 12th place in the span of just one year. America’s score ticked up by more than a full point from last year, reaching the highest level in eight years… The vibrant growth we’re feeling has been unleashed by several key policy changes over the past two years, the most important being the 2017 tax cuts and deregulation. Real gross domestic product grew by upward of 3 percent over the last four quarters – unlike anything seen in the last 13 years. Accordingly, it was no coincidence that we enjoyed the strongest economy in our history prior to the Covid pandemic. It’s also no coincidence that conditions continue to deteriorate under Joe Biden despite the fact that he inherited a growing economy, moderate inflation and vaccines against the Covid pandemic. Rather than promote policies to rectify our alarming decline, however, Biden proposes to deepen our spiral. According to the nonpartisan Tax Foundation, for instance, Biden’s proposals “would give the U.S. the highest top tax rates on individual and corporate income in the developed world.” He also seeks to increase regulation, boost federal spending, reduce labor freedom and restrict financial markets. Thanks to Heritage’s Index, we know what policies work, by objective measure. It’s now a question of persuading or forcing the Biden Administration and Congress to correct course before they make matters even worse. |

Related Articles : |