| The Coming Bernanke-Obama Stagflation |

|

|

By Quin Hillyer

Wednesday, April 27 2011 |

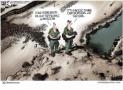

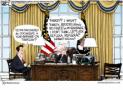

The Federal Reserve Board is badly misunderstanding American psychology, and probably misinterpreting underlying economic realities. Inflation looms like one of the ugliest monsters in Binkley’s Closet of Anxieties, except that this beast is no mere figment of imagination. A public that sees its grocery and gasoline costs rising precipitously will not be mollified by bland reassurances that amount to a great big “Trust Us” sign. First, the numbers. The Washington Post reports that gasoline prices are up 81 cents per gallon just since January 1. (It’s up by $2 per gallon – it more than doubled – since Barack Obama took office.) Economist David Gitlitz notes that “headline CPI inflation is now running at a three-month annualized rate of 6.1 percent,” and that just in the past two years the dollar’s value “against a broad group of U.S. trading partners” has dropped 15 percent. Investors Business Daily highlights an 80 percent hike in those same two years in 23 key commodities not including skyrocketing oil costs. Gold and silver prices, of course, are at stunningly record highs and still rising. After the Federal Reserve on Wednesday again refused to take any action to slow inflation, silver rose by well over $2 in one day, to near $47 per ounce. On a more anecdotal level, The American Spectator’s Jeffrey Lord notes a gallon of milk – same brand, same store – skyrocketing in price by 9 percent (28 percent on an annual basis) in just 102 days. In 54 days, his celery rose by 25 percent. (At that rate, it would double in less than two-thirds of a year!) What was $1.99 is now $2.49. Some stalkers aren’t as scary as those stalk prices. In his precedent-breaking press conference on Wednesday, Fed Chairman Ben Bernanke acknowledged running “a highly accommodative monetary policy.” Translated into English, that means they are printing money, out of thin air, at breakneck speed. He also said that inflation is a “lag” indicator, meaning that it usually shows up months after the policies that cause it. Yet he said there’s no need for worry: “We have a lot of experience” at reading economic data. Commodity price spikes are “transitory.” Petroleum is up mostly because of “geopolitical factors.” That’s not reassuring. The Obama administration still is slowing exploration of most fossil fuels nationwide. Foreign demand continues to rise. CNN’s chief business correspondent, Ali Veshi, is among many making the case that oil prices won’t abate. Further, what Bernanke doesn’t factor into all his talk of low inflationary “expectations” is that consumers don’t have the same expectations that his numbers crunchers do. The Fed economists may discount food and gasoline prices as unstable indicators that aren’t part of “core” inflation, but for most Americans food and gas cost hikes are the very definition of inflation. These are the things they pay for every day; they are the items closest to their psyches. Those gas prices on the big billboards at every filling station have an outsized effect on American psychology. Indeed, I have long argued (both before and after the financial “crisis” of September 2008) that too little attention was paid in 2008 to the effect of that summer’s record gasoline prices on the ensuing panic in the financial markets. Even before Lehman Brothers declared bankruptcy, the $4-per-gallon signs were causing people to panic about their personal finances, all across the country. Their response was to suddenly dial back personal spending on other items across the board. The ripple effects were profound. The “housing bubble” actually didn’t explode; it collapsed. Much of its air was suddenly withdrawn. While big investors clearly did much of the immediate withdrawing, those investors don’t operate in a vacuum. They respond to signals and economic realities surrounding them. Panic trickles upward, and so do the indices that the “real” economy will no longer support high-flying investment practices. All the polls show that the public has far less confidence than Bernanke that the economy is on the right track. Also, the Washington Post reported that 71 percent of Americans consider high gas prices a “financial hardship,” with 43 percent saying it is a “serious” one. These are the expectations, not those of the rarified Fed green-eyeshade folks, which actually matter. These are the expectations that become self-fulfilling prophecies. After Bernanke’s press conference on Wednesday, the dollar dropped to 16-month lows against the Euro, and the price of oil rose. Financial traders clearly know inflation when they see it coming. Yet because most Obama policies – regulatory overreach, calls for higher taxes, etcetera – continue to discourage real investments, there is no potential for a rally on the economy’s supply side. The Fed’s policy won’t stimulate job growth, but only price hikes. Stagflation is baked in the cake. Bernanke is one of the chief bakers. |

Related Articles : |