| FBI Trump Raid Casts Manchin-Schumer IRS Empowerment Bill in Even More Sinister Light |

|

|

By Timothy H. Lee

Thursday, August 11 2022 |

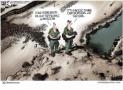

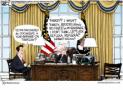

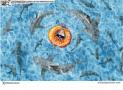

Whatever justification – or lack thereof – Americans ultimately receive for this week’s unprecedented Federal Bureau of Investigation (FBI) raid on former President Trump’s home, we’ve just witnessed a jarring reminder of the federal government’s fearsome enforcement power. As multiple observers note, if this can happen to a former and possibly future president, imagine the potential peril for ordinary citizens. Keep in mind that this is the same FBI that improperly conspired at the highest levels to target former Trump Administration National Security Adviser Mike Flynn. It’s also the same FBI that possessed Hunter Biden’s laptop but nevertheless facilitated the false “Russian disinformation” coverup during the 2020 presidential campaign. Which returns us to the Manchin-Schumer “Inflation Reduction Act”, which is nothing of the sort. After all, as the University of Pennsylvania’s Wharton School of Business study found, the bill will actually increase inflation into the year 2024. A more accurate title would be the Manchin-Schumer “IRS Empowerment Act.” Consider the sheer numbers. The IRS’s current fiscal year budget is $13 billion, but the bill just passed infuses it with an astounding $80 billion. That’s over six times its annual budget, and a 50% increase over the next decade. At a moment of increasing international military threats from China, Russia and Iran, is that enormous boost to the IRS a wise use of taxpayer dollars? In addition to that sudden funding turbocharge, consider the upcoming increase in available IRS personnel. Specifically, according to its own official website, the IRS currently employs 78,661 employees. The new Manchin-Schumer “compromise” bill will add 87,000 more, doubling its size. The parody site Babylon Bee, whose spoof headlines often prove more prescient than mainstream newspapers, perhaps best captured the nature of the increase with its headline “New Bill in Congress Hires an IRS Agent to Live in Every Home.” (If you’re not already following the Babylon Bee, you should.) Although the Biden Administration promises that Americans earning under $400,000 won’t be targeted by this new army of IRS auditors, remember that they’re the same people who one year ago assured us that Afghanistan wouldn’t fall to the Taliban and that inflation was “transitory.” Sure enough, Congress’s own Joint Committee on Taxation projects that between 78% and 90% of any revenues raised from underreported income would be extracted from Americans earning under $200,000, as reported by the Washington Examiner: Republicans pointed to a Joint Committee on Taxation analysis from last year about revenue from underreported income indicating that lower- and middle-class households could be in line for higher tax bills. While Democrats have said the funding would allow the IRS to target millionaires who have avoided paying taxes, the analysis found that of the revenue projected to be raised from underreported income, 40% to 57% would come from taxpayers earning $50,000 or less. It found that 78% to 90% would come from taxpayers making less than $200,000 annually, and a mere 4% to 9% would come from those making more than $500,000 per year. Alarmingly, many of those IRS agents will be armed with more than briefcases. According to OpenTheBooks.com, the increasingly militarized IRS spends millions of dollars on thousands of guns and millions of rounds of ammunition: The Internal Revenue Service, with its 2,159 “Special Agents,” spent $21.3 million on guns, ammunition and military-style equipment between fiscal years 2006 and 2019. The agency stockpiled 4,500 guns and five million rounds of ammunition. What could the IRS possibly intend to do with all of those guns, alongside a doubling of its staffing and resources at its disposal? What we witnessed this week in the FBI raid on Trump certainly isn’t reassuring. Indeed, the IRS’s recent record of malfeasance matches that of the FBI. Remember Lois Lerner, who targeted conservative and libertarian nonprofit organizations? Naturally, she has managed to escape the federal government’s attention since her departure. How many of those 87,000 new IRS agents can we expect to target everyday Americans’ First Amendment freedoms in the manner of Ms. Lerner? Along with its drug price control provisions that will mean hundreds fewer new lifesaving pharmaceutical innovations over the next decade, this legislation is anything but an inflation reduction act. Future congressional and presidential candidates must commit to limiting and repealing this bill, lest what we witnessed this week in the FBI’s raid become commonplace. |

Related Articles : |